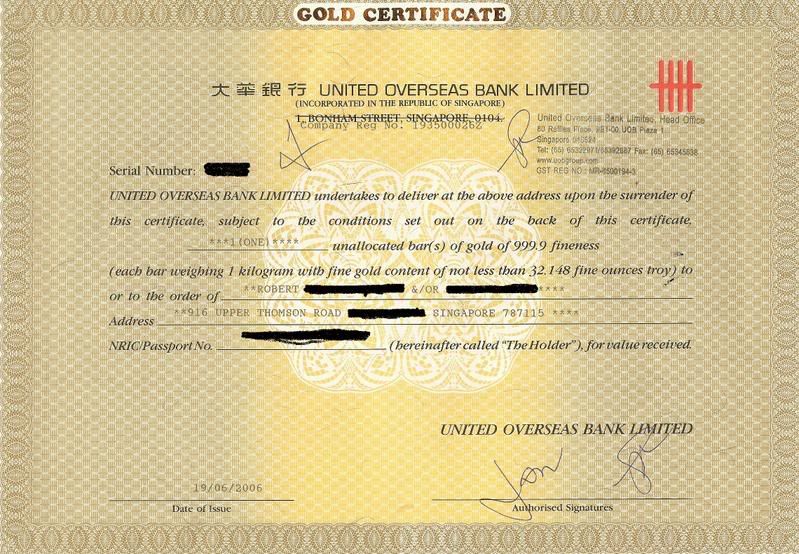

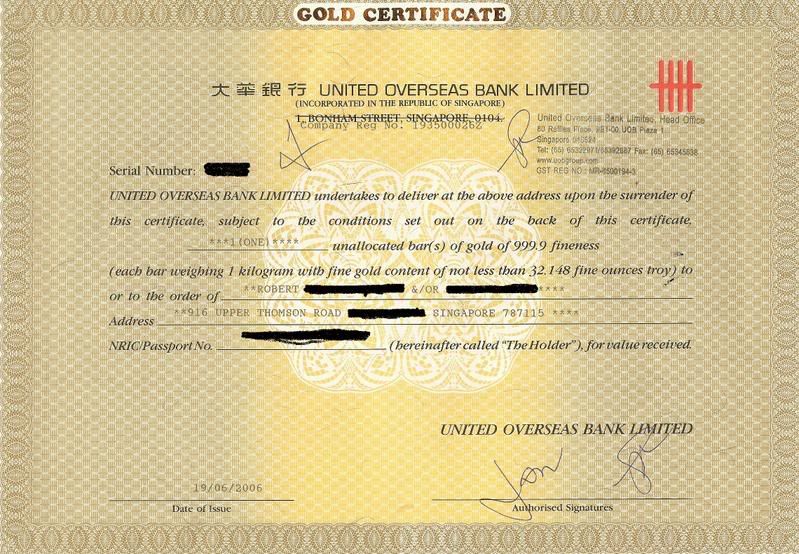

My small collections.

1 OZ gold bullion coins

from 19-07-2007 to 12-08-2008

@ S$1140.62 to S$1317.17

now UOB selling at S$1927.07

. No intention of selling since the price is good now? If you are not selling then how long do you intend to keep these coins? Just want some opinion on how you guys handle gold.

. No intention of selling since the price is good now? If you are not selling then how long do you intend to keep these coins? Just want some opinion on how you guys handle gold.

Comment