Originally posted by rh1667

View Post

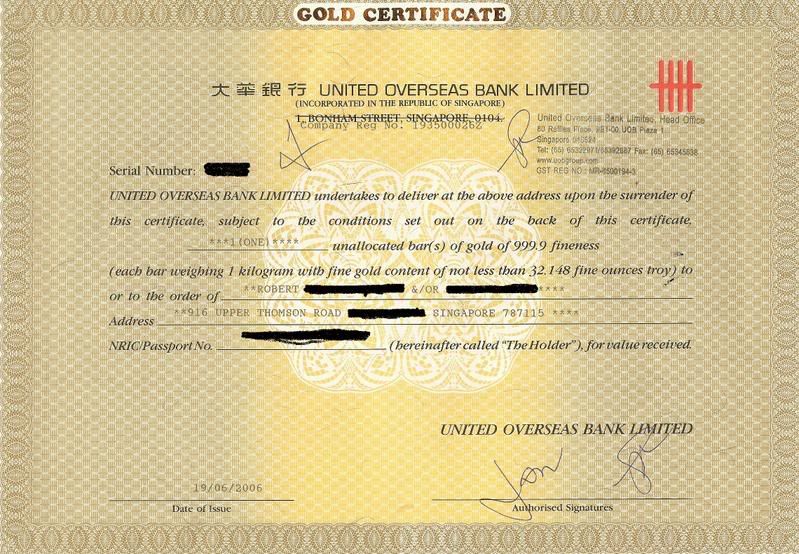

UOB will sell you just about anything you want, I bought these certificates a kg at a time and they can be either sold back to UOB or you can collect the physical 1kg of gold. There is a 5 SGD charge per year for storage or admin (not sure) for each certificate. Her is one of ours I scanned:

As for buying silver or gold here is the online link for checking out the prices, just click on the link and click on Rates & Fees, then click on gold and silver prices and a popup will come up showing the current prices for gold and silver they sell via passbook, certificate and physical ownership.

http://www.uob.com.sg/personal/inves...us_metals.html

Comment